Is AI the New Electricity [Guest]

A leading investor shares some thoughts on the right analogy for AI

Hey, it’s Devansh 👋👋

Our chocolate milk cult has a lot of experts and prominent figures doing cool things. In the series Guests, I will invite these experts to come in and share their insights on various topics that they have studied/worked on. If you or someone you know has interesting ideas in Tech, AI, or any other fields, I would love to have you come on here and share your knowledge.

I put a lot of effort into creating work that is informative, useful, and independent from undue influence. If you’d like to support my writing, please consider becoming a paid subscriber to this newsletter. Doing so helps me put more effort into writing/research, reach more people, and supports my crippling chocolate milk addiction. Help me democratize the most important ideas in AI Research and Engineering to over 100K readers weekly. Many companies have a learning budget that you can expense this newsletter to. You can use the following for an email template to request reimbursement for your subscription.

PS- We follow a “pay what you can” model, which allows you to support within your means, and support my mission of providing high-quality technical education to everyone for less than the price of a cup of coffee. Check out this post for more details and to find a plan that works for you.

The following is a guest post by Eric Flaningam, my favorite resource for understanding the business side of the Tech Markets. His ability to look both across the industry and go deep into specific topics is unmatched. Every article I’ve read from him has given me a new perspective on the developments in the space. Eric shares his insights through the Substack publication Generative Value. Would very strongly suggest signing up for it to never miss his insights. E is one of the smartest people I’ve met, and he always has something interesting to say (you might think I’m glazing, but this article will convince you otherwise).

This article draws parallels b/w the AI buildout happening currently and the Electrification that happened a century ago. Analogies like this can be very helpful for us to forecast the future of a rapidly shifting field like AI. This article was extremely well-researched (as with all of Eric’s work), and I thought it would be a great springboard for discussion in our community.

As you read here are a few questions I would like to hear your thoughts about-

A huge reason AI model inference has cut down so much is the pressure from the open source movement and the loss leader + blitz scaling (operate at losses to take market share very rapidly) strategy that applies in tech. Did the cut in electricity costs have similar influences? If not, how apt would that point of comparison be? Another wrinkle to this, inspired by

(another one of Substack’s top game spitters)- Electrification required laying down the groundwork. Much of AI’s distribution was enabled by preexisting rollouts( OSS, Tech, SaaS, etc.). Gen AI companies fight more over adoption. Add to that the fact that many huge problems in the world can be solved with current intelligence capabilities (and “ASI”, if possible, would be massively overkill there). How does that change market dynamics?Globalization and the internet are rewriting societies faster than ever before. How does that change the dynamics (by the time electrification happened, the Industrial Revolution had been around a few years) of the buildout (which is by it’s nature a project that requires a degree of stability).

The Open Source Movement is unique to Tech. How does that factor into the conversation?

Electrification faced heavy government intervention and regulation. Regulations can help standardize and stabilize the industry, boosting progress in the long run (having identically sized and composed bricks lets us build big buildings). Should AI infrastructure face similar regulatory frameworks? If so, what form should they take? Imo, transparency is the most important aspect, along with reworking the education system to inculcate constant education. Where do you think we should look? What about the ethics of training on data or industries built around auditing AI pipelines used by companies?

I am concerned about AI increasing inequality, especially with more value added elements. As such, we will eventually need to think about providing not just access but also the environment in which people can use it effectively.

If AI becomes a commodity, what would the derivatives market around AI look like?

Regardless of the particulars of the era, one thing has remained constant: Life is endlessly chaotic and random. Where others may see failure and risk, Chaos rewrites existing power structures and thus provides abundant opportunities to those who can take them. Where AI goes from here is very much an open question, and now is the best time to shape the world in our image. Thinking actively about history and iterating on what we learn from it is how we will do that. I’d love to hear your thoughts on how AI will mimic historical patterns and, more importantly, what you believe its future should look like.

“There are, perhaps, few things finer than the pleasure of finding out something new. Discovery is one of the joys of life and, in our opinion, is one of the real thrills of the investment process. The cumulative learning that results leads to what Berkshire Hathaway Vice-Chairman Charlie Munger calls “worldly wisdom”. Worldly wisdom is a good phrase for the intellectual capital with which investment decisions are made and, at the end of the day, it is the source of any superior investment results we may enjoy.” - Nick Sleep, 2010 Annual Letter

In pursuit of “worldly wisdom,” I’ve been thinking about where we may be headed with AI and the right analogy that hints at that future.

While there’s no shortage of analogies for AI (I’m sorry for contributing to the problem), I heard Jeff Bezos compare AI to electricity, and I think he’s right. Through my studies of data centers and the electric grid, there have been hints of this analogy. As promised in my annual letter, I’d like to add more substance to that theory.

Now, every analogy has glaring logical holes (this one is certainly no exception!) So, I’ll call out the three parallels I think are most relevant.

AI Data Centers & the Early Electric Grid

GE & Vertical Integration

The Utilities of the AI Age

For those in a hurry, the key analogy is this: (1) The price of intelligence is dropping rapidly like the price of electricity, unlocking more use cases for intelligence/electricity. It compounds on itself: more applications drive more usage (bigger market) which drops costs which unlocks more applications. Oh, and vertical integration is an important competitive advantage if done correctly.

For those looking for a bit more worldly wisdom, feel free to read on.

If you’re curious why I’m writing about this (a divergence from my typical industry/company deep dives), there are two reasons:

It’s easy to fall into “data collection” mode as investors, but spending some time wandering in thought is well spent! As Nick Sleep told us: “In today’s information-soaked world there may be stock market professionals who would argue that constant data collection is the job. Indeed, it could be tempting to conclude that today there is so much data to collect and so much change to observe that we hardly have time to think at all. Some market practitioners may even concur with John Kearon, CEO of Brainjuicer (a market research firm), who makes the serious point, “we think far less than we think we think” - so don’t fool yourself!”

Perhaps more importantly, information is commoditized, while wisdom is becoming scarcer. Something to think about, if you will. Consider this my call to action, to (attempt to!) provide more wisdom and a little more of my thoughts in this newsletter (as much as readers can bear to hear, I suppose).

Thirdly, I was reading Confessions of an Advertising Man, and David Ogilvy said, “You can’t bore people into buying.” While it’s abhorrent to say semiconductors and data centers are boring, it can’t hurt to throw a lighter read in once in a while!

Back to our regularly scheduled programming.

1. The AI Data Center Buildout

The US electric grid was initially built out 100+ years ago, and it’s remarkably similar to today’s AI Data Center Buildout.

I first noted the resemblance between the electric grid buildout and the AI data center buildout last year:

The scaling of power plants: From 1890-1920, electric companies built the largest power plants they could. Relative performance increased as power plants grew, so electric companies supersized their power plants, much like the mega data centers of today.

“Astronomical” CapEx investments: In 1900, it was estimated that the electric industry would need $2B (or $62B in today’s dollars) over the coming five years to meet demand. As Construction Physics describes, “As one financier observed at the time, the amount of money required by the burgeoning US electrical system was “bewildering” and “sounded more like astronomical mathematics than totals of round, hard-earned dollars.”

The plummeting cost of electricity: Much like the cost of compute today, electricity prices dropped precipitously with scale. These price decreases led to the conclusion that electric utilities were “natural monopolies,” meaning that electricity was a race to the bottom and that the largest providers with scale would dominate the market.

Much like others infrastructure buildouts, these investments are both expensive and necessary. The upfront costs eventually lead to the dropping cost of service over time. This is what happened with electricity and it’s what happening to inference today.

The difference is that inference costs have decreased by ~90% over the course of 18 months. It took decades for it to happen to electricity.

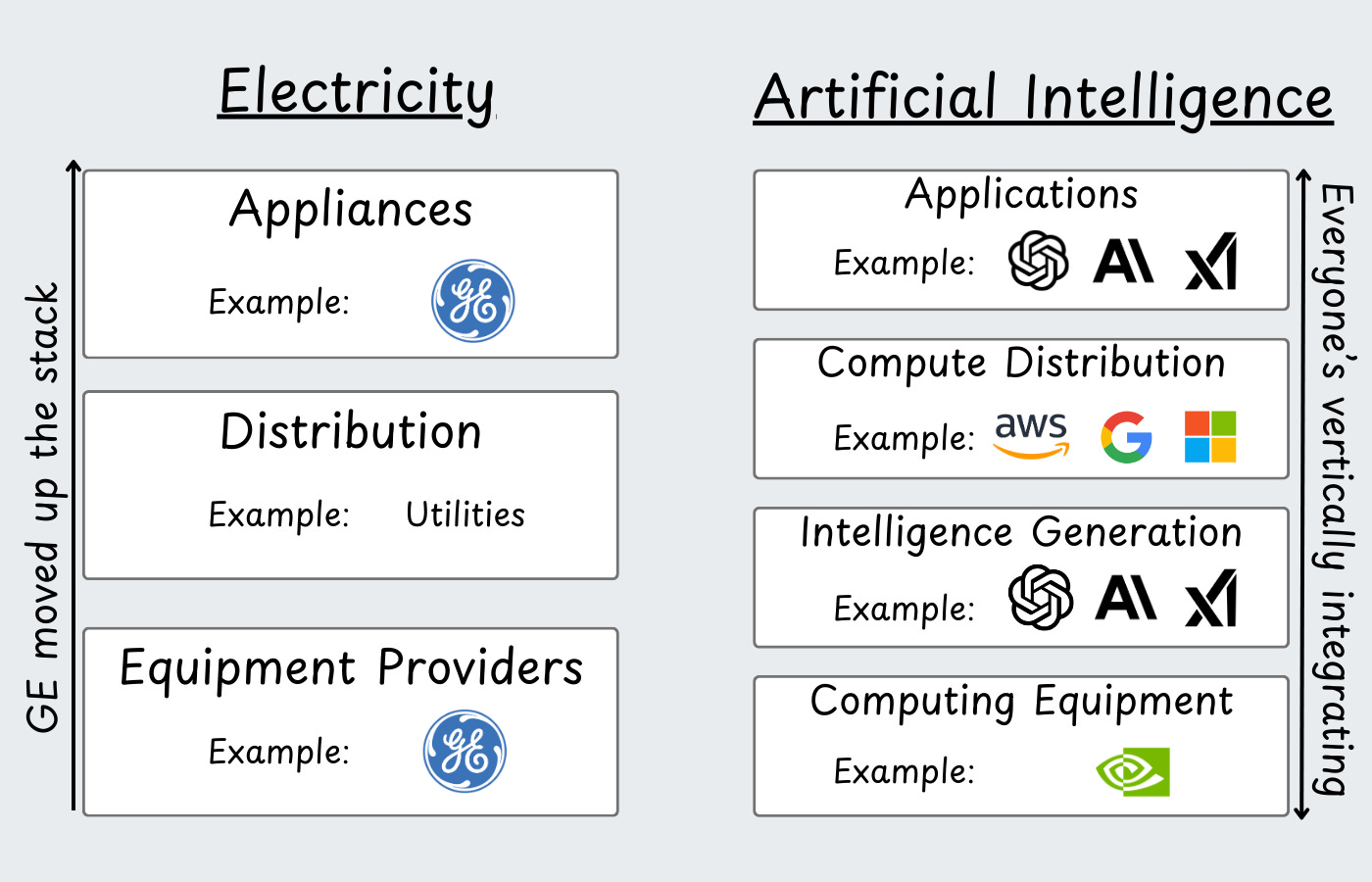

2. GE & Vertical Integration

The infrastructure buildout is the first parallel, the pursuit of vertical integration is the second.

Thomas Edison unlocked the first great use case for electricity with the lightbulb. He then helped pioneer the early electric grid and the entire energy industry.

GE would dominate power generation in the early 1900s, becoming something like the Nvidia for power - providing the turbines, motors, and electrical equipment for the burgeoning electric industry.

That market growth began to slow as the US became electrified:

GE was a cash cow and needed expansion (sound familiar?). In 1917, Sears released an advertisement that said “Use your electricity for more than light.”

And that they did.

The US saw the golden age of appliances ushered in that would last for ~50 years. GE expanded up the stack to appliances, and solidified their position as one of the giants of American industry.

We’re seeing a very interesting trend among the AI companies of today. Nvidia’s expanding to models and software. OpenAI’s reportedly designing their own chips, while already competing in the model and application layer. The hyperscalers are completely vertically integrated (at least in theory).

The one exception to GE’s vertical integration (over the long term) is that utilities ultimately owned the distribution of electricity while GE provided the equipment and, eventually, the applications.

3. The Utilities of the AI era?

Perhaps the most interesting question in this analogy is: who becomes the utilities of the AI era?

First, we have to view computing as a utility for the logic to hold up. We have historical precedent!

In the early 1970s, “timesharing” companies like University Computing Company had a huge boom (and ensuing bust) on the idea that you could split up computers and allow many people to use them at once. The Engines that Moves Markets describes the time,”The commercial focus of the time was therefore on ‘utility computing’ and this was reflected in the financial markets.”

IBM was talking about computing as a utility in the early 2000s. See this quote from a 2005 “Intro to Grid Computing” Handbook:

One other type of grid that we should discuss before closing out this section is what we will call e-utility computing. Instead of having to buy and maintain the latest and best hardware and software, with this type of grid, customers will have the flexibility of tapping into computing power and programs as needed, just as they do gas or electricity.

They were calling the cloud “e-utility computing”! Catchy!

Of course, the cloud became the default way to access compute power, and the hyperscalers became something like “computing utilities.”

The question then becomes: who distributes AI and who manages the customer relationships?

Clearly, the hyperscalers are well positioned to be the “distributors of AI” as well. I’d argue a company like Cloudflare fits the description well, and even the new age of inference providers look like they could fill that position! These companies all own the computing equipment, operate it, and distribute it to customers.

4. So why this diatribe about electricity and AI?

If the electric industry is a good guide, we’ve just started to see AI applications being built.

It took many decades for the infrastructure to be laid for the electrical industry to be ready for the appliances.

With AI, the infrastructure is already in place. We’ve got the physical infrastructure, the cloud to distribute compute, the software infrastructure to build software, and we have the software applications to integrate AI into!

Jeff Bezos gave a TED talk in the ruins of the dot-com bubble in 2003, and shared this quote:

“If you really do believe that it’s the very, very beginning, if you believe it’s the 1908 hurley washing machine, then you’re incredible optimistic. And I do think that’s where we are. And in 1917, Sears - I want to get this exactly right. This was the advertisement that they ran in 1917. It says: “Use your electricity for more than light.” And I think that’s where we are. We’re very, very early.”

The thing with innovation is that it’s never been good to bet against it. In 2003, Jeff Bezos was right; he was just early, and it took a long time to achieve that vision. For AI today?

I think that’s where we are. We’re very, very early.

As always, thanks for reading!

Disclaimer: The information contained in this article is not investment advice and should not be used as such. Investors should do their own due diligence before investing in any securities discussed in this article. While I strive for accuracy, I can’t guarantee the accuracy or reliability of this information. This article is based on my opinions and should be considered as such, not a point of fact. Views expressed in posts and other content linked on this website or posted to social media and other platforms are my own and are not the views of Felicis Ventures Management Company, LLC.

Thank you for reading, and I hope you have a wonderful day.

Dev <3

I provide various consulting and advisory services. If you‘d like to explore how we can work together, reach out to me through any of my socials over here or reply to this email.

I put a lot of work into writing this newsletter. To do so, I rely on you for support. If a few more people choose to become paid subscribers, the Chocolate Milk Cult can continue to provide high-quality and accessible education and opportunities to anyone who needs it. If you think this mission is worth contributing to, please consider a premium subscription. You can do so for less than the cost of a Netflix Subscription (pay what you want here).

If you liked this article and wish to share it, please refer to the following guidelines.

That is it for this piece. I appreciate your time. As always, if you’re interested in working with me or checking out my other work, my links will be at the end of this email/post. And if you found value in this write-up, I would appreciate you sharing it with more people. It is word-of-mouth referrals like yours that help me grow. You can share your testimonials over here.

Reach out to me

Use the links below to check out my other content, learn more about tutoring, reach out to me about projects, or just to say hi.

Small Snippets about Tech, AI and Machine Learning over here

AI Newsletter- https://artificialintelligencemadesimple.substack.com/

My grandma’s favorite Tech Newsletter- https://codinginterviewsmadesimple.substack.com/

Check out my other articles on Medium. : https://rb.gy/zn1aiu

My YouTube: https://rb.gy/88iwdd

Reach out to me on LinkedIn. Let’s connect: https://rb.gy/m5ok2y

My Instagram: https://rb.gy/gmvuy9

My Twitter: https://twitter.com/Machine01776819

Great piece. Yes, both need massive infrastructure. Electricity built the grid; AI is building data centers. Both dropped in cost, unlocking new applications. But here’s the break: Electricity became a utility—standardized and universal. AI? It’s fragmented, proprietary, and controlled by a few dominant players.

The real question: Does AI become a commodity like power, or will it stay an elite, high-margin game? And if it does get commoditized—what’s the derivatives market for AI intelligence?

Must read📖